Certainly, you have had to turn customers away because they did not have the medical financing to pay for the services they needed. By turning customers away you are losing business.

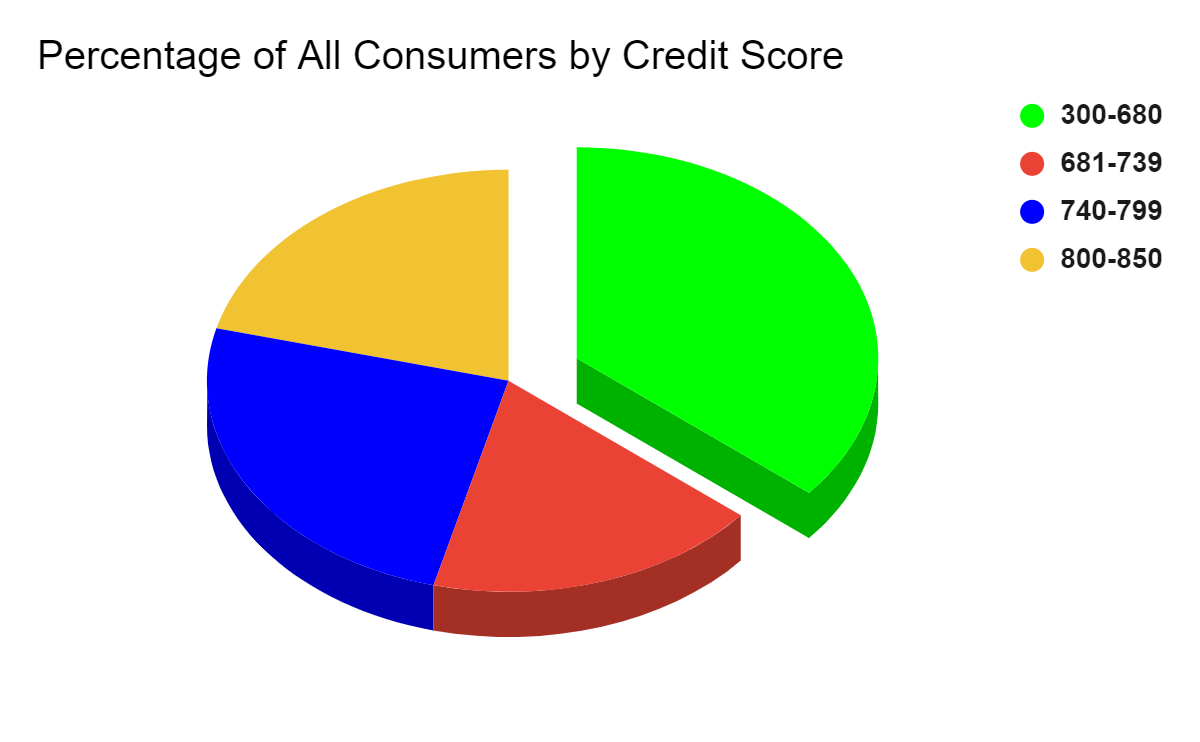

There is an untapped market that contains 36% of all consumers. These consumers have credit scores below 680. This is the group that cannot always qualify for traditional patient financing services. And you could completely be missing this group of consumers who need medical loans for bad credit.

By offering medical financing to people with credit scores below 680 you can beat out the competition. Those competitors aren’t giving these consumers an option of patient financing services to pay for what they need. By providing the medical financing that these consumers need and want, you are helping them all the while growing your business. If 36% of consumers’ credit scores are below 680, then almost twice that amount is above 680. You might currently be only getting business from 64% of all available customers. By offering medical loans for bad credit to those in need, you are closing the gap and gaining a much larger market for your business.

You have the opportunity to grow from this untapped 36% of the consumer market without compromising your time with patients. TGUC Financial can help you free up time to do the work that is important to you while helping you grow your business. TGUC Financial has three options for you. They have varying yields, time frames, and risk. We can help you choose the option that works best for you.

These options are:

- Client Billing Option

- Your client pays monthly loan payments and you receive the payments monthly.

- This option has the highest yield of 108% and the longest time frame of twelve months.

- This option also has the highest risk as you own the risk for twelve months.

- Billing to Purchase Option

- Your client pays monthly payments which you receive until TGUC Financial investors purchase the rest of the loan.

- This option has a higher yield of 91% and a shorter time frame of about 3 months.

- This option also has a lower risk since you own the risk for about three of the twelve months.

- Upfront Purchase Option

- TGUC Financial investors may purchase the loan outright at origination.

- This option has the lowest yield of 84% and the shortest time frame of zero months.

- This option also has the lowest risk since TGUC Financial investors own all the risk. Please note that TGUC Financial investors do not commit to purchasing all consumer loans. Talk to us about your options, including any limitations and expectations.

When you partner with TGUC Financial to offer patient financing services, you provide a quick and easy application process for your patients and then can provide them with the various medical-related services they need. And you receive immediate payment for services rendered. These patient financing services come at no cost to you and simple, low-interest plans for your patients. In addition to growing your business by increasing your customer base, depending on the medical financing plan, you can also earn extra income from the interest that the customer is paying.

Now, you don’t have to let your patients walk out the door. You can keep them healthy and happy by providing them with the patient financing services they need regardless of their credit situation. And you are able to tap into an entirely new customer base and grow your business.

Recent Comments