What if your loan funding doesn’t come in time? TGUC Financial can help you make offering patient financial services part of your stimulus during these uncertain times. Like many other businesses right now, you may have applied for an SBA or PPP loan to help you during this unprecedented time of COVID-19. However, you are not the only one who has applied for these loans. A large portion of the allotted funds have already been claimed, and while there are discussions to provide additional funds, there is no guarantee that it will happen. The funds that are currently available are on a first come first-served basis.

Additionally, banks have experienced an overwhelming volume of applicants and it is taking a while for applications to be processed. Needless to say, if you are able to get your application processed, it may be a while before you receive funds. During “normal” situations, SBA loans have a long application process which is anywhere from 2-3 months. And it can take up to 4 months to receive your funds. This is where TGUC Financial can help you to be proactive and offer patient financial services to your clients.

Right now it is prudent to think of other ways to generate revenue, so you can keep the doors financially open once you are able to actually open the doors to your business physically. TGUC Financial can help both you and your customer by offering patient financing. You will likely have even more clients who are unable to pay for the services they need and do not qualify for traditional medical financing. TGUC Financial offers you the ability to provide patient financing to everyone, covering a full range of credit situations, so you never have to turn anyone away from what they need. So, not only can you sustain your business, but you can actually grow your business by not losing theirs. And they can benefit by getting the services they need in a time when they are most likely to need them direly.

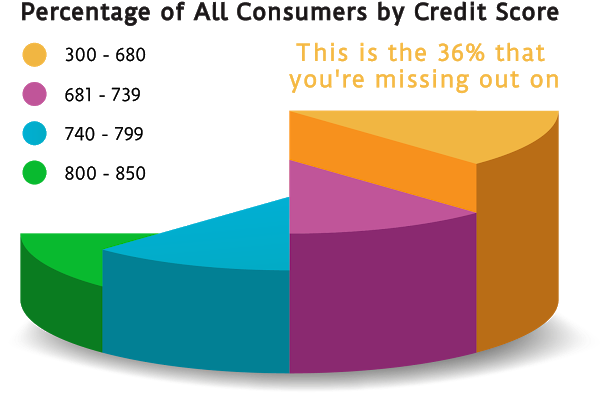

There is an untapped market that contains 36% of all consumers. These consumers have credit scores below 680. This is the group that cannot always qualify for traditional patient financing services. Undoubtedly, this number is growing during this time. Now is the time for both you and your customer to benefit from what TGUC has to offer with its patient financial services, so you aren’t missing this group of consumers who need medical loans for bad credit.

By offering medical financing to people with credit scores below 680 you can also beat out the competition allowing you to generate more business when you need it the most. Those competitors aren’t giving these consumers an option of patient financing services to pay for what they need. By providing the patient financing that these consumers need and want, you are helping them all the while generating much needed revenue for your business.

TGUC Financial is a resource to finance your customers and begin generating revenue immediately. We are offering a free set up for our patient financial services as we are waiving any upfront fees to accommodate you during this time of rebuilding. Experts say that most businesses need to accept that there will be a decline and we will all be suffering the consequences of these unprecedented times. But, if you plan accordingly, you can reduce the impact these times have had on your business.

When you partner with TGUC Financial to offer patient financing services, you provide a quick and easy application process for your patients and then can provide them with the various services they need. You also benefit by receiving immediate payment for services rendered. As we said, these patient financing services come at no cost to you and simple, low-interest plans for your patients. In addition to generating immediate revenue by increasing your customer base and your target market, depending on the medical financing plan, you can also earn extra income from the interest that the customer is paying.

It is so important right now to take proactive measures to keep your business afloat while you work to rebuild from the loss of business you’ve experienced. Offering patient financial services from TGUC Financial will provide you the immediate funds you need to generate immediate revenue that you have been missing or to enhance what you are getting via an SBA or PPP loan. But using TGUC Financial as part of your stimulus plan, you don’t need to wait for the funds.

Partner with us today to get started with patient financing, so you can rebuild your business while helping patients desperately in need as well.