Best Personal Loans For Home Improvement

Get personalized pre-qualified offers with no impact to your credit score.

Why TGUC For Personal Home Improvement Loans?

What Our Customers Say

How TGUC Works For Personal Home Improvement Loans

1 Pre-qualify

2 Select offer

3 Receive funding

Our Trusted Partners

Join more than 2,000 Contractors

Get local leads delivered at no additional cost.

Personal Loans For Home Repair, Remodels & Renovations

Is your home in need of some TLC? A personal loan for home improvement may be a great option to help you get the renovations done.

Whether you’re looking to update your kitchen, add a new deck or simply add a fresh coat of paint to the walls, a personal loan is one of the easiest ways to finance home improvements. So what are personal loan home improvement loan rates? Are personal loans for home improvements tax deductible?Where can you get the best personal loans for home improvements? Keep reading to find out.

A homeowner should understand the type of renovation they are doing and the best financing options to choose from. There are two types of home loans for repairs and home improvement projects. Secured loans and an unsecured loan are two financing options that a homeowner should check out before renovating their homes.

Read more

How To Get A Personal Loan For Home Improvement?

First you’ll need to decide what type of loan you are pursuing – unsecured or secured. Next, you can start shopping offers. Most banks, credit unions, and online lenders can offer personal loans for home improvements. Most commonly these loans will be unsecured. If you have an accurate project estimate, you can get pre-qualified for the appropriate loan amount. Online lenders often offer the most convenience and sometimes even the best rates too.

Can I Get A Personal Loan For Home Improvements?

Personal loans are often used for home improvements. Oftentimes they require no collateral and fixed monthly payments making them easier to secure than secured loans. On the downside, they may have higher interest rates than secured loans.

Which Loan Is Best For A House That Needs Improvements?

It varies, depending on your situation.

If you have owned the home for some time then you may have equity in your home. If so, you can use a home equity loan or home equity line of credit for major home improvements.

If you’re buying a home that needs improvements right away, then you may want to look into an FHA 203(k) loan.

Home improvement loans can be used in most cases – so you should take this option into consideration as well.

What Is The Cheapest Way To Borrow Money For Home Improvements?

The cheapest way to borrow money usually depends on what you qualify for. If you use a fixed-rate loan, you can calculate the total loan cost upfront. If you use a variable-rate loan, total loan costs may fluctuate during the life of the loan. Installment loans or personal loans are usually a cheaper way to borrow money compared to a credit card.

What Is A Home Improvement Loan Called?

A home improvement loan is a personal loan that you can use to finance any type of home improvement project. These loans can be used for anything from minor renovations like painting or new flooring, to major projects like adding an addition or finishing a basement.

Home improvement loans are typically unsecured, which means they are not backed by collateral like a home equity loan or HELOC. Instead, lenders will base their approval decision on your personal credit history and income. Home improvement loans can be a great way to finance a wide range of home improvement projects, but it’s important to compare your options and find the best loan for your needs.

Are Home Improvement Loans Tax Deductible?

Secured home improvement loans can be tax deductible. Unsecured personal loans are typically not tax deductible, which is why we encourage homeowners to use them for smaller projects.

Can You Add Renovation Costs To Conventional Mortgage?

Conventional mortgages typically do not allow for the addition of renovation costs. However, if you have enough equity in your home, you may be able to refinance or borrow against your home to cover renovation costs.

Can You Borrow Against The Value Of Your Home?

Yes, you can borrow against equity in your home. If your home value has increased significantly since you purchased it, this may increase your borrowing power. However, when you borrow against your home, you are using it as collateral. In the event you default on the loan, you may be forced out of your home. While you can borrow generous loan amounts at a reasonable cost, you should consider the risks involved with borrowing against your home.

When Buying A House How Do You Pay For Renovations?

If you’re buying a home that needs major renovations, you should consider using a FHA 203(k), VA renovation loan, HomeStyle, or CHOICErenovation loan. These loans can help you finance the cost of the home as well as necessary renovations. If the home needs, or you just want, minor renovations (i.e. new floors, appliances, etc.) you may want to take out a personal loan along with a traditional mortgage.

What Is A Conventional Rehab Loan?

A conventional rehab loan is a loan that is used to finance the costs of renovations and repairs to a property. Rehab loans are typically short-term loans, with terms ranging around six months. And because they are typically used for investment properties, they usually require a higher down payment than traditional mortgages.

However, rehab loans can be an attractive option for borrowers who are looking to purchase a fixer-upper or who need extra cash to make repairs on their current home. Because rehab loans are backed by the property itself, they often come with lower interest rates than other types of loans. As a result, borrowers can save money on interest payments while still making significant improvements to their home.

How Do You Fund A Personal Renovation Project?

One option is to save up the money over time. Easier said than done though. To afford renovation projects most homeowners turn to financing. Personal loans are a popular option for renovations because they come with little to no restrictions and fixed monthly payments.

For some of the best home improvement loans, visit TGUC Financial. In a few easy steps, you can receive personalized home improvement loan offers which can lead you to the money you need for a monthly payment you can afford. Once you have your funds in line, TGUC can even help you find a trustworthy and skilled contractor to finish the job.

What Is a Personal loan for Home Improvement Loan?

A personal home improvement loan is a loan borrowed by homeowners to renovate and repair their house without equity percentage and collateral. In simple terms, homeowners don’t have to borrow money against their property. This personal loan doesn’t have a lot of requirements, like a higher credit score, a high equity percentage, or the need for various income sources.

Borrowing a personal loan for a home improvement project is the best option compared to home equity loans, home equity lines of credit, cash-out refinancing, and other financing options because these options have a lot of limitations. There are many personal loan lenders and homeowners should consider many factors to choose the best. This article will help you with 10 effective steps to choose the best personal home improvement loan lender for you.

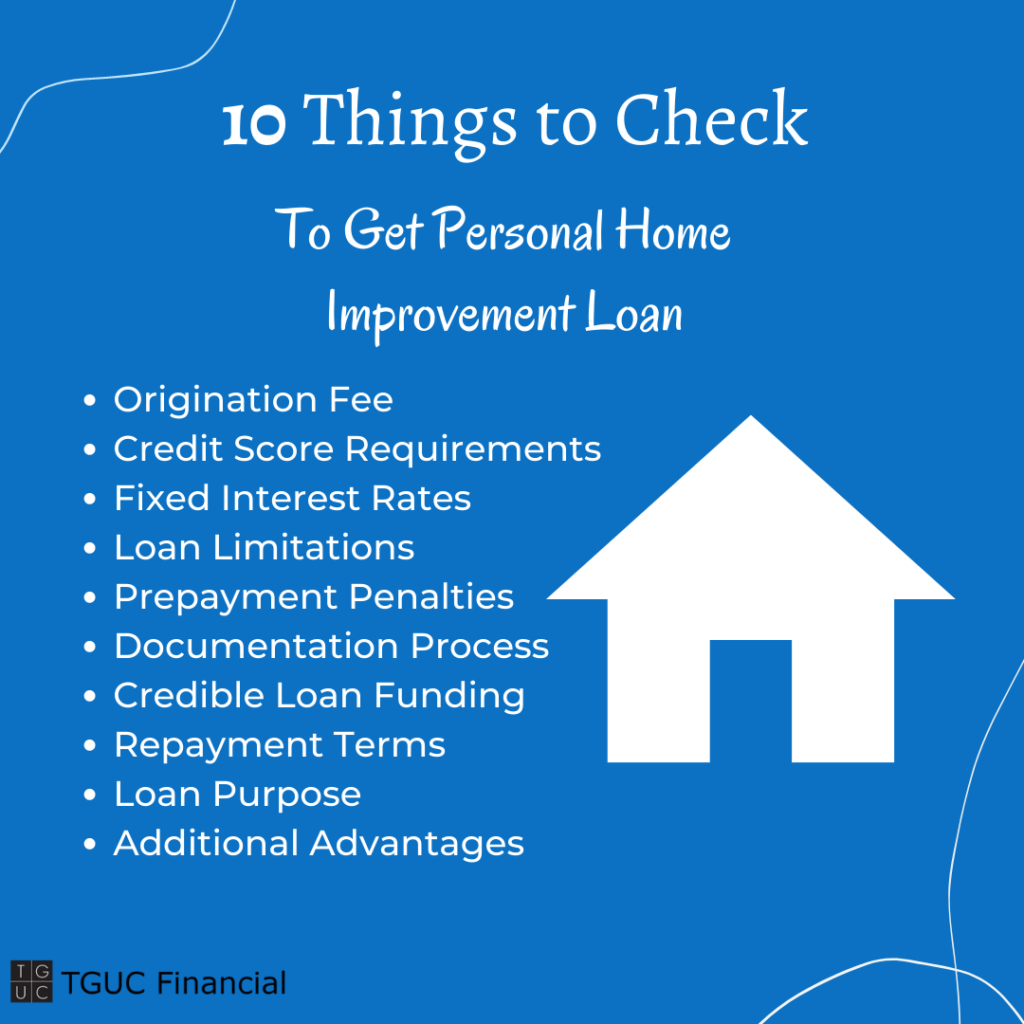

10 Effective Tips to Borrow Personal Home Improvement Loan

While borrowing a personal loan from lenders, you will first have to check the fluctuating interest rates, the prepayment fees, the loan terms, and other limitations. Some home improvement loans are only applicable for emergencies or small repairs. So if you are planning on a large renovation, you should consider the limitations, too! Let us look into 10 effective tips to get an affordable personal loan for your home improvement.

1. Personal Home Improvement Loan Origination Fees

Some personal lenders will ask for origination fees before borrowing the amount. An origination fee is a sum of the amount charged by the lender before giving the loan amount. Asking for an origination fee is not really a bad idea, but homeowners should check the amount before paying it. An origination fee should not be more than 0.5% to 1.5% of a loan amount.

If an origination fee exceeds more than 1.5%, a homeowner should check APR and compare it with other financing options. It is always a better idea to compare the origination fees of different personal loan options before signing up.

2. Check Minimum Credit Score Requirements For A Personal Home Improvement Loan

You have planned an excellent home improvement project, so what is the next step? Is it checking your budget and credit score? A credit score is significant to borrow for your home improvement, but you don’t have to maintain excellent credit scores to get a personal home improvement loan.

Having an excellent credit score might be an intimidating requirement for homeowners. Checking the minimum credit score requirements is necessary before applying for a home improvement loan. There are many affordable loan options where online personal loan lenders offer home improvement loans to borrowers with a low credit score.

3. Fixed Interest Rate and Monthly Payments

Renovating your home is one of the best ways to increase the value of your property. But, if you pay higher interest rates and monthly payments, your interest rates may exceed the increased value of your home. In the home equity line of credit option, the interest rate may fluctuate based on your home equity percentage. Before applying for a loan for home improvements, homeowners should check the interest rates and monthly payments.

4. Check Personal Home Improvement Loan Limitations

As we have already discussed above, home improvement projects vary from minor to major renovations. Some online lenders will only offer loans for minor renovations, like plumbing. If you have major repair or renovation works, you should check the limitations before opting for that financing option.

Personal loans don’t usually have a rigid geographic location requirement, like FHA grant programs, but checking geographic limitations is also wise before applying for a loan. If you are planning to renovate your home in an urban area, you should check with home improvement loan lenders. Some lenders limit their renovations to rural areas and minor renovations.

Homeowners Can Get Loans without Geographical Restrictions!

Are you looking for a personal loan for home improvements without geographical restrictions? Well, you can now renovate your home with personal home improvement loans from TGUC Financial!

TGUC Financial offers home improvement loans for Wisconsin, Florida, and Utah. If you are planning to renovate your home in Wisconsin or Utah, TGUC Financial will find you the best home improvement contractors near you and offer loans with minimum requirements. Florida home improvement loans are also beneficial for homeowners to find remodeling contractors with affordable loan terms.

5. Prepayment Penalties

You have now checked the interest rates, origination fee, and loan limitations. What is next? Checking the prepayment penalty should be next on the list. If you don’t know what a prepayment penalty is, you might have missed an important factor to check before applying for a personal loan.

A prepayment penalty is an amount charged by the loan lender if you pay interest rates initially without any delay, a lender might charge a prepayment penalty. Most of the online lenders benefit from the interest rates, if you pay the amount early it might be a financial loss for lenders.

Homeowners should check prepayment penalty details before borrowing a loan. A prepayment penalty is not necessarily bad, but you should check the amount before applying for a home improvement loan. In a nutshell, prepayment penalties shouldn’t break your budget.

6. Documentation Process

Homeowners don’t have strict requirements in the personal loan option. In other financing options, checking the credit score, equity percentage will be time consuming. In a personal home improvement loan, one can easily get approval with minimum requirements like income verification. When you have decided to apply for a loan, checking the documentation process is necessary to know about the requirements.

Sometimes, you might have an emergency repair and need the loan approval immediately. Checking the documentation is necessary to analyze the credibility of loan terms. When homeowners apply for a personal loan, checking the documentation process will eliminate a lot of risks and speed up the process.

7. Credible Personal Home Improvement Loan Funding

Many online lenders check your credit report, verify your income, and have various other requirements to qualify you for the loan term. In the same way, homeowners should also check the credibility of personal loan lenders before applying for a loan.

Checking the license of the lender, and their past home improvement projects will pave a way for you to decide whether you can apply for a loan or not. Credible loan funding should not make you fall into debt.

8. Repayment Terms

Homeowners should check the repayment terms before borrowing loan amounts from a lender. Formulating a plan to repay your loan is effective to manage your budget.

Without planning your repayment terms, it is difficult for homeowners to decide on the amount to pay. Homeowners should calculate the minimum loan amount for the renovation and remodeling works. In the same way, strategizing a way to repay your loan and the maximum time period to pay it is also necessary. After deciding on the maximum period, homeowners should also check with the loan lenders about repayment terms.

9. Loan Purpose

You have now checked everything! Have you decided on the purpose of your personal home improvement loan? If you are borrowing a loan for large renovations, did you check the types of renovations and calculate the budget?

If you are borrowing a kitchen or bathroom remodeling loan, you may need a lump sum for remodeling works. Kitchen and bathroom additions are large renovations and require a good amount of money. Homeowners need to analyze the loan purpose and remodeling works before they apply for a personal loan.

10. Personal Loans with Additional Advantages

Comparing different personal loan funds with loan amounts, credit history, and minimum requirements is important. It is always a great idea to compare the best home improvement loans. A lot of personal loan options give you additional advantages like finding the best home remodeling contractors with good background checks.

TGUC Financial will find you the best home remodeling contractors near your location with valid licenses and credibility checks. After applying for a loan, finding the best home improvement contractors is another challenging job! TGUC Financial will reduce this time-consuming task for homeowners.

When Should You Choose a Personal Home Loans for Repairs and Renovation?

If you are planning a home renovation, you should first calculate the budget. The homeowner should decide the type of renovation and estimate the amount he/she is planning to spend on the renovations.

To pay the amount for the renovations, homeowners may need to borrow a home improvement loan. As mentioned above, even if there is a minor repair, fixing it professionally may be more beneficial for homeowners. Financing their home with credit cards may only be applicable for minor repairs. On the other hand, home equity loans, cash-out refinancing, personal loans, and home equity lines of credit are some financing options that a homeowner can use for home repairs and renovations.

How Do You Qualify for a Personal Home Improvement Loan?

As mentioned above, qualifying for personal loans is not a difficult task. The personal home improvement loan option doesn’t have a lot of requirements. Homeowners should check their minimum credit score and equity percentage to qualify for loans. In the personal loan option, there are basic requirements, like income verification

Homeowners can qualify for the loan with basic requirements for emergency repairs. The process of applying for personal loans is not a difficult task.

- Income Verification

- Personal Details

- Get Your Loan Terms and Select a Contractor

If you are planning to renovate your home quickly with few requirements, a personal loan is the best option. TGUC financial offers a personal loan with just three steps. Homeowners need not have an excellent credit score or equity percentage with this option.

Final Word

While comparing the advantages and disadvantages, a personal loan can benefit homeowners with minimum requirements. Homeowners should not delay their home improvement project as it benefits them in various ways.

Your home is a space that should feel comfortable and welcoming. Remodeling your home is the best way to make your home more welcoming to your visitors. While renovating the home, homeowners should also make sure that the renovation cost doesn’t exceed the net worth. Personal loan terms are flexible for every homeowner and will not break your budget.

If you have planned to renovate your home, you should never have to delay it due to financial reasons. The personal home improvement loan option is the holy grail for homeowners. Homeowners will most likely be able to get affordable home improvement loans with minimum requirements with this option.

With TGUC Financial, getting qualified for a home improvement loan is not a challenging task. Homeowners just have to follow three steps to qualify for the loan. If you have decided to renovate your home, don’t postpone it!

Frequently Asked Questions

What are the disadvantages of personal home improvement loans?

Not borrowing money from a credible source is the main disadvantage of a home improvement loan. The interest rates and loan terms will fluctuate if you are not thoroughly checking the online lenders you are interested in before you apply.

What are the maximum loan terms for personal home improvement loans?

25 years is the maximum loan term for home renovation loans. If you are repaying a loan for more than 25 years, it might exceed your increased home value.